Starting with How to Retire Early in 10 Years, this introduction aims to draw readers in with a glimpse of the topic’s importance and intrigue.

The following paragraphs delve into the key aspects of achieving early retirement through financial planning and investment strategies.

Setting Financial Goals: How To Retire Early In 10 Years

Setting clear financial goals is crucial when aiming to retire early within a span of 10 years. These goals provide a roadmap for your financial journey and help you stay focused and motivated along the way.

Identifying Financial Milestones

- Save an emergency fund equivalent to 6-12 months of living expenses within the first year.

- Max out retirement account contributions annually to take advantage of tax benefits and compound interest.

- Accumulate at least 25 times your annual expenses to achieve financial independence.

Role of a Detailed Budget

A detailed budget is essential in tracking your income and expenses, allowing you to make informed decisions on where to cut costs and save more. It serves as a tool to ensure you are on track to meet your financial milestones within the desired timeframe.

Examples of Financial Goals

- Short-term goal: Pay off all high-interest debts within the first 3 years.

- Long-term goal: Invest in income-generating assets to replace your working income by year 8.

Building a Robust Savings Plan

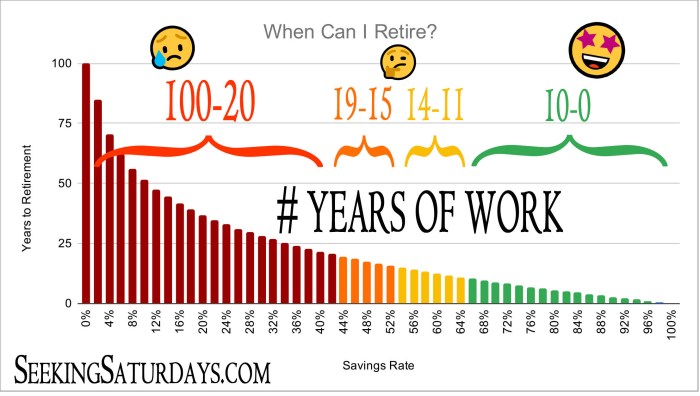

Saving a high percentage of your income is crucial when aiming for early retirement. The more you save now, the faster you can build up your nest egg and achieve financial independence.

The 50/30/20 Rule vs. the FIRE Movement Approach

- The 50/30/20 rule suggests allocating 50% of your income for needs, 30% for wants, and 20% for savings and debt repayment. This method provides a balanced approach to managing your finances.

- On the other hand, the FIRE (Financial Independence, Retire Early) movement advocates for saving a much higher percentage of your income, often around 50% or more. This aggressive approach allows for early retirement within a shorter time frame.

Automating Savings and Investments

Automating your savings and investments is a smart way to stay disciplined and consistent with your financial goals. By setting up automatic transfers from your paycheck to your savings or investment accounts, you remove the temptation to spend that money elsewhere.

Cutting Expenses to Maximize Savings Potential

- Track your expenses to identify areas where you can cut back. This could involve reducing discretionary spending on dining out, entertainment, or shopping.

- Consider downsizing your living space, finding more affordable alternatives for necessities, or negotiating better deals on recurring bills like utilities or insurance.

- Look for creative ways to save money, such as meal prepping instead of dining out, using public transportation or carpooling to save on gas, or utilizing cashback and rewards programs for everyday purchases.

Investing Wisely

Investing wisely is crucial when aiming for early retirement. By starting early and consistently putting money into suitable investment vehicles, individuals can maximize their returns and build a substantial nest egg for retirement.

Suitable Investment Vehicles for a 10-Year Retirement Plan

- Stock Market: Investing in individual stocks or exchange-traded funds (ETFs) can offer high returns over the long term.

- Real Estate: Rental properties or real estate investment trusts (REITs) can provide a steady income stream and potential for property value appreciation.

- 401(k) or IRA: Taking advantage of tax-advantaged retirement accounts can help grow savings faster due to compounding interest.

Asset Allocation and Diversification, How to Retire Early in 10 Years

Asset allocation involves spreading investments across different asset classes such as stocks, bonds, and real estate to reduce risk. Diversification, on the other hand, means investing in a variety of assets within each class to further minimize risk. By diversifying and allocating assets strategically, investors can achieve a balance between risk and return that aligns with their financial goals.

High-Return Investment Options with Moderate Risk Levels

- Index Funds: These funds track a specific market index and offer broad diversification with low fees.

- Dividend-Paying Stocks: Companies that pay dividends can provide a steady income stream while offering potential for capital appreciation.

- Peer-to-Peer Lending: Investing in peer-to-peer lending platforms can generate passive income with moderate risk levels.

Generating Passive Income Streams

Building passive income streams is crucial in achieving early retirement as it allows you to earn money without actively working for it. This consistent cash flow can provide financial stability and freedom, helping you reach your retirement goals faster.

Sources of Passive Income

There are various sources of passive income that individuals can explore to build wealth over time:

- Real Estate: Investing in rental properties or real estate crowdfunding can provide a steady stream of passive income through rental payments or property appreciation.

- Dividends: Investing in dividend-paying stocks or funds allows you to earn regular income from your investments without needing to sell assets.

- Online Businesses: Creating digital products, affiliate marketing, or starting a blog can generate passive income through advertising, product sales, or affiliate commissions.

Strategies for Building Passive Income

When aiming to retire early in 10 years, consider the following strategies to develop passive income streams:

- Diversify Investments: Spread your money across different income-producing assets to minimize risk and maximize returns.

- Reinvest Profits: Instead of spending your passive income, reinvest it to grow your portfolio and generate more wealth over time.

- Automate Processes: Use technology and automation tools to streamline your passive income sources, saving time and effort in managing them.

Examples of Successful Passive Income Ventures

Many early retirees have found success in building passive income streams. Some examples include:

- Real Estate: Purchasing rental properties and leveraging property management services to generate rental income consistently.

- Dividend Investing: Building a diversified portfolio of dividend-paying stocks and reinvesting dividends to compound returns over time.

- Online Businesses: Creating a profitable niche website or e-commerce store that generates passive income through affiliate marketing or product sales.

Wrap-Up

To wrap up, this discussion highlights the essential steps and considerations for those aiming to retire early within a decade, offering a comprehensive guide to financial freedom.